How to Price Your Products in Your Business Plan

How to Price Your Products in Your Business Plan

How to Price Your Products in Your Business Plan

When writing a business plan in Nigeria, how to price your products in your business plan is one of the most important parts that many people overlook. How to price your product or service in your business plan is of great importance. What is your profit margin? Can customers afford your price? Will it sustain your business?

These questions can determine whether your business succeeds or fails — especially when you’re pitching to investors, applying for a grant, or seeking funding.

Pricing is more than just picking a random figure. It’s a strategy. Your price must reflect your costs, your value, your customers, and your competition. It must also match your business goals — whether that’s making profit, gaining market share, or creating a premium brand.

In this guide, you’ll learn how to price your products properly and how to present it clearly in your business plan.

Table of Contents

- Why Pricing Is Important in Your Business Plan

- What to Consider Before Setting Your Price

- Understanding Your Cost Price

- Choosing the Right Pricing Strategy

- How to Calculate a Profitable Selling Price

- Showing Pricing in Your Business Plan

- How to Adjust Your Prices Without Losing Customers

- Pricing Mistakes to Avoid in Your Plan

- Final Thoughts

- Need Help Starting Your Business?

- Frequently Asked Questions (FAQs)

Key Takeaways

- Pricing is not guesswork — it should be based on cost, value, and market demand

- You must know your total cost per unit before setting a price

- Choose a pricing strategy that matches your business goals

- Clearly show your pricing in the financial and product sections of your plan

- Always consider your target customer’s income level and spending behavior

- Pricing too low can harm your profit; pricing too high can push customers away

- Test your prices and review regularly as your business grows

How to Price Your Products in Your Business Plan

How to Price Your Products in Your Business Plan

-

Why Pricing Is Important in Your Business Plan

Your price directly affects your profit, sales, and ability to survive. In your business plan, the pricing section helps funders or partners understand:

- Whether your business can make money

- If your price is realistic for your target market

- How you compare to other competitors

- Whether you’ve done your homework on costs and value

Without clear pricing, your plan looks weak or incomplete. It also makes it harder for you to estimate future income and growth.

-

What to Consider Before Setting Your Price

Before you set a price, you need to look at a few key areas:

- Your production or purchase cost — How much it costs to make or buy one unit

- Your target market — What your customers can afford and are willing to pay

- Your competition — What others are charging for similar products or services

- Your brand position — Are you targeting high-end, affordable, or budget buyers?

- Your profit goals — How much profit do you need to grow or survive?

- Your business location — Prices in Lagos may differ from prices in Gombe or Aba

All these factors help you arrive at a price that is fair, profitable, and attractive.

-

Understanding Your Cost Price

Your cost price is the total amount it takes you to produce, package, and deliver one unit of your product or service.

There are two main types of costs:

- Fixed costs – These don’t change based on how much you produce. Examples: rent, business registration, staff salaries.

- Variable costs – These increase or decrease with each unit. Examples: raw materials, packaging, delivery, labor per item.

Add both to know your true cost per unit.

Example:

You run a small zobo drink business.

– Bottle cost = ₦50

– Ingredients per bottle = ₦70

– Label = ₦30

– Electricity and gas (shared) = ₦20

Total cost per bottle = ₦170

You cannot sell for ₦150 and expect profit. That’s why knowing your cost price is key.

-

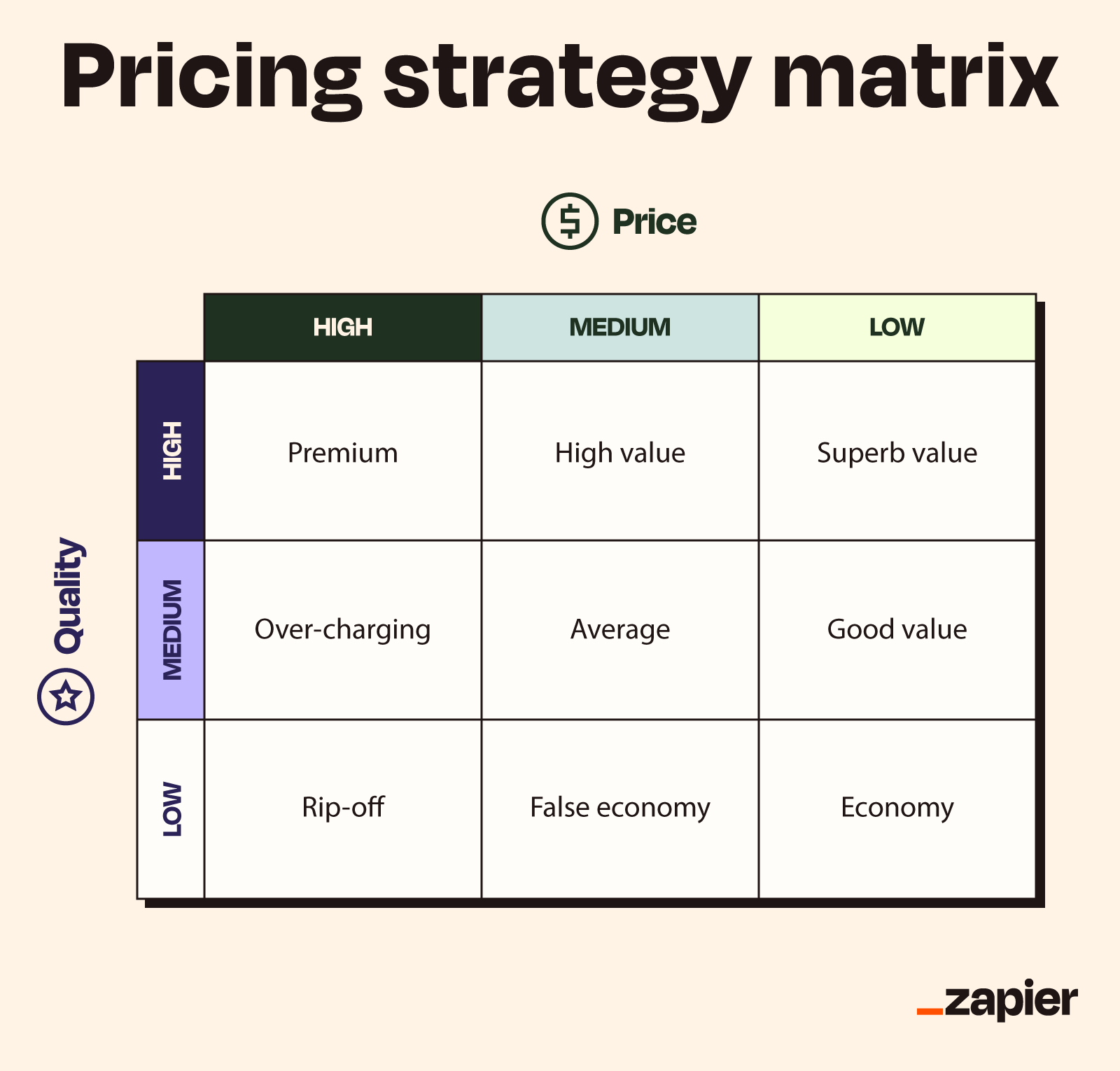

Choosing the Right Pricing Strategy

There are several pricing strategies, and your business plan should show which one you’re using — and why.

Cost-plus pricing – Add a profit margin to your cost

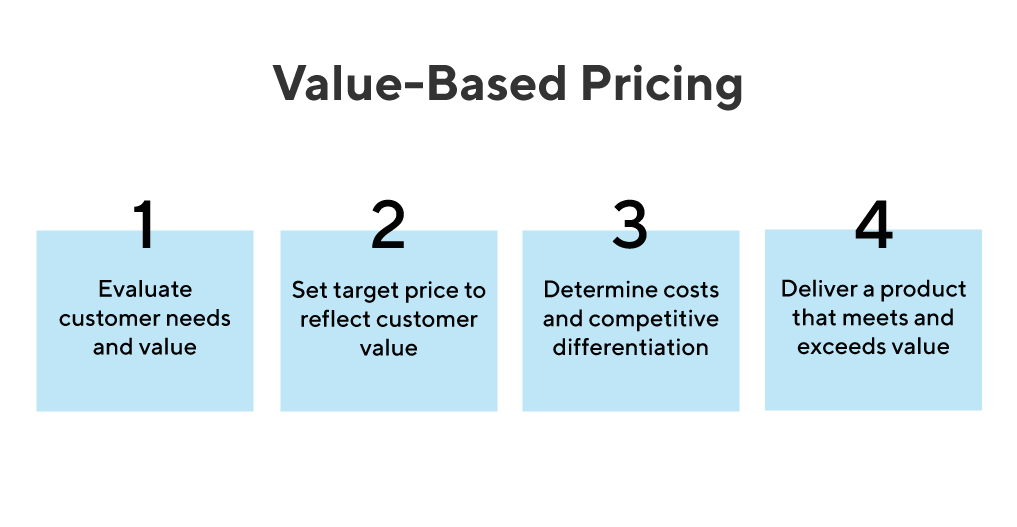

Value-based pricing – Charge based on the value you provide, not just cost

Competitive pricing – Price slightly below, equal to, or above your competitors

Penetration pricing – Start low to attract customers, then increase later

Premium pricing – Set a high price to create a luxury or exclusive brand image

Bundle pricing – Sell items in packages to increase value and convenience

Your pricing strategy should align with your market, brand, and goals. Explain this clearly in your plan.

-

How to Calculate a Profitable Selling Price

Use a simple formula to determine your price:

Selling Price = Cost Price + Desired Profit

Or in percentage:

Selling Price = Cost Price ÷ (1 – Desired Profit Margin)

Example:

If your cost per unit is ₦170, and you want a 30% profit margin:

Selling Price = ₦170 ÷ (1 – 0.30)

Selling Price = ₦170 ÷ 0.70 = ₦243

So you should price your product around ₦240–₦250 to make a 30% profit.

You can adjust this based on market realities, but this gives you a clear, solid base.

-

Showing Pricing in Your Business Plan

When writing your plan, there are two main places to include your pricing:

-

In the Products and Services Section

Clearly list each product or service and its price. Example:

– Zobo drink 50cl – ₦250

– Smoothie 40cl – ₦700

– 3-in-1 combo pack – ₦1,800

-

In the Financial Plan Section

Show how your pricing affects your revenue projection. Use tables if needed.

Example:

| Product |

Unit Price |

Monthly Sales (units) |

Revenue |

| Zobo 50cl |

₦250 |

600 |

₦150,000 |

| Smoothie 40cl |

₦700 |

150 |

₦105,000 |

| Total |

– |

– |

₦255,000 |

This gives your reader a clear picture of how your pricing leads to profit.

-

How to Adjust Your Prices Without Losing Customers

Sometimes, you may need to raise prices — due to inflation, supplier changes, or business growth. But how do you do this without scaring away customers?

- Add more value — better packaging, faster service, freebies

- Give advance notice and explain why prices are changing

- Offer bundles or loyalty discounts to reduce the shock

- Introduce price changes gradually, not all at once

- Target new customers while retaining loyal ones with special deals

Don’t be afraid to charge what your product is worth. Cheap isn’t always better — especially when your quality is high.

How to Price Your Products in Your Business Plan

How to Price Your Products in Your Business Plan

-

Pricing Mistakes to Avoid in Your Plan

Avoid these common errors Nigerian entrepreneurs make when presenting pricing:

- Guessing your price without calculating cost

- Copying competitors blindly without understanding your own numbers

- Setting prices too low just to get customers — you’ll run at a loss

- Overpricing without justifying your value

- Not including all costs — forgetting transport, packaging, or electricity

- Hiding your price in the plan — investors want transparency

Take your time to research and explain your pricing clearly. It builds trust and shows professionalism.

Final Thoughts

Pricing is one of the most important decisions you’ll make in your business — and it must be done right. A good price allows you to make a profit, grow your brand, and serve your customers well.

In your business plan, don’t just write random prices. Show your calculations, explain your pricing strategy, and connect it to your revenue goals.

Remember, your price speaks about your value. Price smart. Price confidently. And don’t be afraid to charge what your work is worth.

Read Also: How to Write a One Page Business Plan That Works

Need Help Starting Your Business?

At Dayo Adetiloye Business Hub, we help Nigerians like you start and grow profitable businesses — no matter your budget. From writing business plans to getting registered and finding the right business idea, we’ve got your back.

Call or WhatsApp us on +234-806-077-9290

Let’s build your dream business — together!

Frequently Asked Questions (FAQs)

How do I calculate the right price for my product?

Start by calculating your total cost per unit, then add your desired profit margin using a clear formula.

Should I copy my competitors’ prices?

Not blindly. Use their prices for comparison, but base your own on your cost, value, and customer target.

What if customers complain my price is too high?

Explain your value, improve your service, or offer bundles. Don’t drop prices too fast — focus on quality.

Can I use different prices for different locations?

Yes. Pricing can be adjusted based on local demand, delivery costs, or purchasing power in different areas.

What’s the best pricing strategy for a new business?

Start with cost-plus pricing, then test value-based or competitive pricing as your market grows.

How do I show my prices in a business plan?

Include prices in the Products/Services section and use them in your revenue projections under Financial Plan.

What if my price is low but I’m still not getting customers?

It may not be the price — check your branding, marketing, or product quality. Low price doesn’t always mean more sales.

Should I change my prices often?

No. Change only when necessary — for cost changes, inflation, or new offerings. Always notify your customers.

Can I price my services the same way as products?

Yes, but factor in your time, tools, transport, and effort as your “cost” before adding profit.

10. Where can I get help with pricing or financial planning?

You can contact Dayo Adetiloye Business Hub for expert guidance and tailored business support.

Related